It’s not enough to do the work; you also have to get paid. One of the biggest challenges facing freelancers and business-to-business entrepreneurs alike is how to handle that moment when a client fails to pay. The good news is that, by and large, it’s a painless process which shouldn’t lead to a big fallout between the business and the client. However, sometimes you do need to take things further and knowing when that moment comes is an important skill.

Perhaps, the most important aspect of client management for freelancers and business-to-business entrepreneurs is getting paid. After all, we don’t work just for the fun of the work – we do it to keep a roof over our heads, provide for our families, etc.

Mike Monteiro, who delivered the most popular CreativeMornings talk ever, sums this up succinctly and says business owners need to remember that “f*ck you, pay me” is the motto creative business owners need to live by.

Author/Copyright holder: David Rutledge. Copyright terms and licence: CC BY 2.0

Author/Copyright holder: David Rutledge. Copyright terms and licence: CC BY 2.0

Mike Monteiro sums this up succinctly and says business owners need to remember that “f*ck you, pay me” is the motto a creative business owner needs to live by.

The Basics of Getting Paid

The most important thing for you to do is to ensure that you have defined what payments are due, when they are due and how they should be made in your contract with your client.

Charging a deposit at the start of an engagement is also important; payment of a deposit tends to keep the client focused on the work and reduces the chances that they will turn around at the end of a project and try to get away without paying for some minor reason or another.

It’s also a good idea, on larger projects, to break payments into a series of smaller payments for minor deliverables. Ideally, you should have 90% (or thereabouts) of your payment prior to handing over the final deliverable. This minimizes the risk to your cash flow if a client decides to become problematic at the final payment stage.

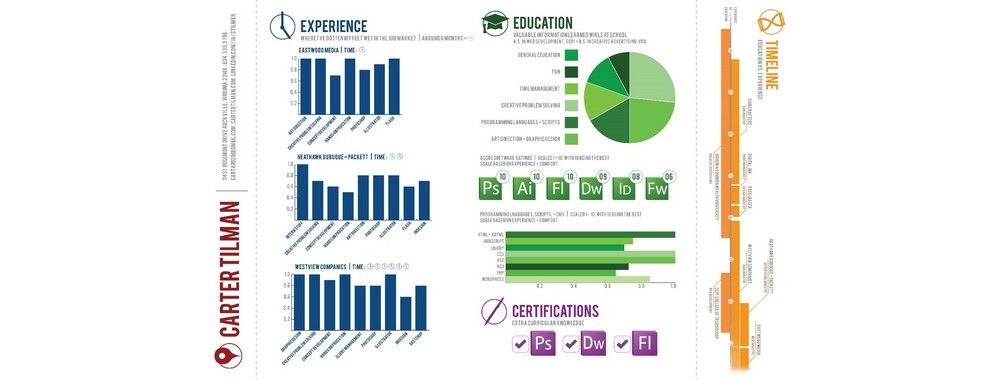

Author/Copyright holder: Recrea HQ. Copyright terms and licence: CC BY-NC-SA 2.0

Author/Copyright holder: Recrea HQ. Copyright terms and licence: CC BY-NC-SA 2.0

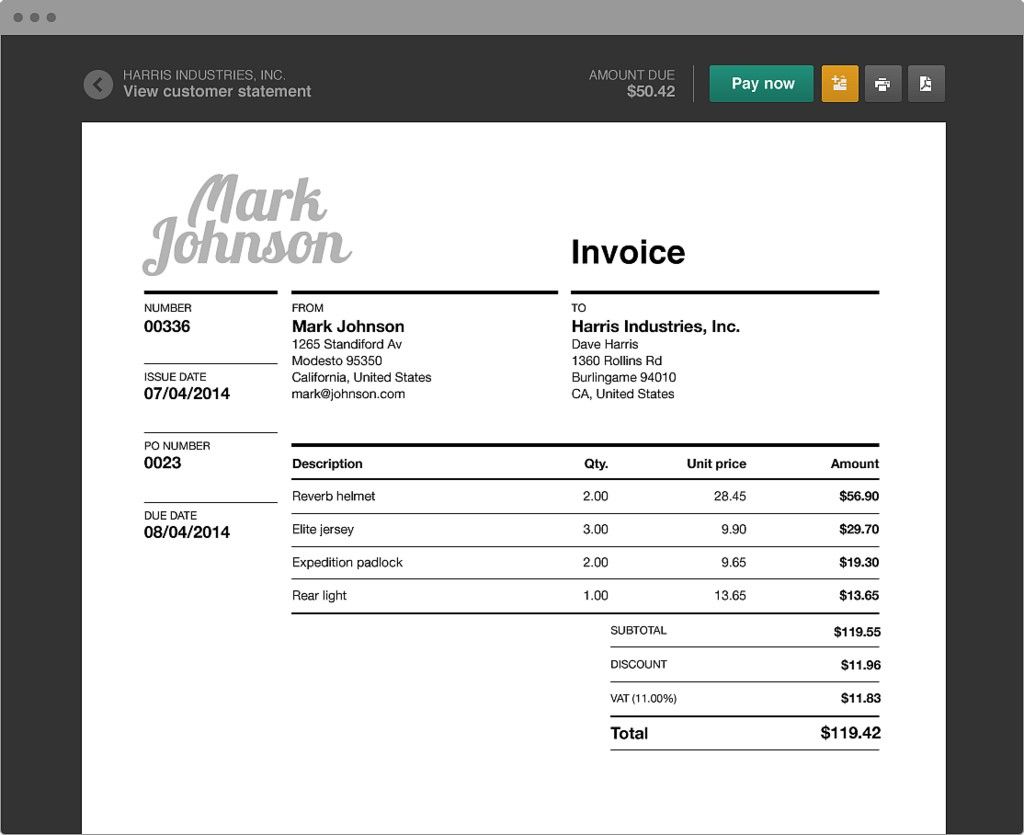

There is no standard template for an invoice. However, there may be certain information required on an invoice by your legal environment – make sure you have this covered.

Invoices vs. Receipts

Invoices

An invoice is a demand for payment. If you are working directly with a client (as opposed to using Upwork/Guru/Etc. – where an invoice is generated automatically), you will need to generate an invoice for them to pay.

An invoice should contain:

An invoice number

A date of issue

An expected payment date

A description of the work carried out

Your details (contact, payment, etc.)

The client’s name and the contact name of the person who will pay the invoice

A thank-you for the work

Your company registration number (and VAT registration number) if you are invoicing as a company

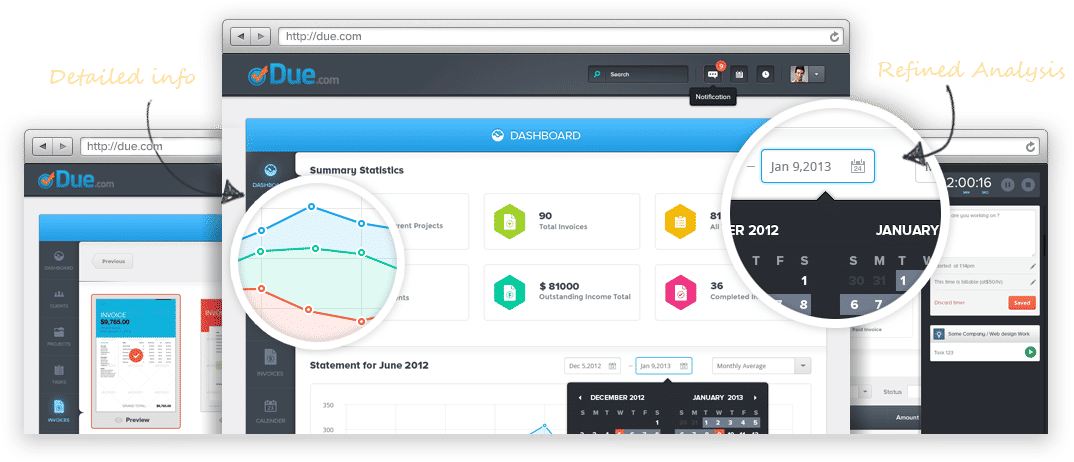

Invoices are a near-mandatory part of modern work. An invoice does not require a fancy template or pretty design, though you are welcome to design an invoice any way you like. If you don’t want to create your own invoices, services abound online where you can generate invoices. Two examples of this are Due (at Due.com) and FreshBooks (at Freshbooks.com). Author/Copyright holder: Due.com. Copyright terms and licence: Fair Use

Author/Copyright holder: Due.com. Copyright terms and licence: Fair Use

Invoicing services such as Due also offer reminder services when invoices become overdue and let you track your overall invoicing progress.

It’s worth noting that in some jurisdictions, the invoice may need to be signed and/or include a copy of the company stamp (or chop). It’s a good idea to ask your clients before you need to send an invoice what they would like included in the invoice or what must be included.

Receipts

A receipt, on the other hand, is confirmation of payment – it’s sent after you receive the money from the client. It’s worth noting that receipts are not mandatory for most jurisdictions and you don’t have to send a receipt in this case.

What to Do When the Client Doesn’t Pay an Invoice

The majority of clients, at least in our experience, are good people. You send an invoice, and they pay it within the terms agreed upon. However, there are always some clients who won’t pay. They may ignore your invoice—they may genuinely have forgotten to pay, or they may be unwilling to pay (and they may or may not tell you this). If this happens—it’s time to follow a simple process.

Step 1 – Give the Client the Benefit of the Doubt

The first step in this process is to give the client the benefit of the doubt. Wait three or four days beyond the payment date and then send a polite reminder (with another copy of the invoice)—something like: “Hi, Ms. Client, I am sure that this has just slipped your notice, but I’d appreciate it if you could make payment now. Please let me know if you have any concerns or questions. Kind Regards, Me.”

Step 2 – Be Firm and Polite

If this doesn’t work, wait one more week and then send another notice—be firmer in this one. “Hi, Ms. Client, I’ve sent two notices regarding payment now. I would appreciate it if you could make payment today; otherwise, I may have to escalate this to my legal team which will incur charges as laid out in our contract. Please accept my apologies if you have already made payment; if you could send confirmation of that payment, it would be much appreciated.”

Step 3 – Get Assistance from Your Lawyer

Normally, even the most recalcitrant of clients will pay up at this point, but a tiny minority will need further encouragement. Next, it’s time to instruct a lawyer to send the client a note requesting payment (plus the cost of the lawyer’s fees for writing the letter) and explaining that the next step will be legal action. This sort of client may infuriate you, but remember the adage—“Don’t get mad; get even.”

Step 4 – Take Legal Action or Accept the Loss

If you still don’t get paid, you must make a choice. You can take legal action, but you should weigh up the costs involved before you proceed. In some cases, it may be better to write off the client’s debt as bad debt rather than pay for legal action. In others, it will be clearly economic to pursue legal action. Some freelancers will take action even if it causes further losses as a point of principle. It’s up to you how far you take this.

Step 5 – Alternatives If Legal Action is Not Worth Pursuing

Even if you decide not to take legal action, you can still report the client to their industry body (if they have one) and leave feedback on their Better Business Bureau (or equivalent) report online. In some cases, this feedback will have the desired effect of getting you paid; in others—at least you’ll have the satisfaction of knowing that it will deter other freelancers from involving themselves with the client in future. Such questionable clients will be the source of their own undoing. Thankfully, they’re the exception, not the rule.

Author/Copyright holder: Audrius Meskauskas. Copyright terms and licence: CC BY-SA 3.0

Author/Copyright holder: Audrius Meskauskas. Copyright terms and licence: CC BY-SA 3.0

A receipt will usually contain the line items paid for and a thank-you of some description. It may also need to comply with any legal needs in your environment. If you use an automated invoicing service—it should generate the receipts for you, too.

The Take Away

Getting paid is vital to your business. It begins with the contract and then follows a simple process if the client is reluctant (unwilling) to pay.

You should never let this process deteriorate into personal abuse or rage. If the client raises an issue, you should, if the issue is reasonable, attempt to rectify the problem in order to get paid. If the client becomes aggressive or obnoxious or is completely unreasonable, let your lawyer handle him/her/them (it’s what they get paid for). Before you take legal action, weigh up the costs of the action beforehand, as in some cases it may be better to write off the client’s debt as bad debt rather than pay for legal action.

You should be careful with your cash flow as a business owner. Until the money is in the bank, you can’t spend it. Some clients will take longer than expected to pay. Some may never pay (even if you win a legal action against them). Ensure that you don’t overexpose your business and livelihood to a single source of risk.

Author/Copyright holder: Tom Simpson. Copyright terms and licence: CC BY-NC-ND 2.0

Sadly, there are a few clients who think like this… taking action over non-payment early will help you avoid larger financial problems at a later date.

References & Where to Learn More

Hero Image: Author/Copyright holder: Thomas Hawk. Copyright terms and licence: CC BY-NC 2.0

Mike Monteiro’s superlative (if NSFW) video: F*ck You, Pay Me

Note: If you use one resource in all of your freelance career—make it this one. This is an incredibly important concept and will help your business go from strength to strength. Just don’t watch it at work – there’s some strong language in it.