There are a lot of ways to structure freelance pricing and it’s important to get it right. Charge too little and you won’t make ends meet and you’ll be an employee again before you know it. Charge too much and you won’t get any business but how much is enough?

Know Your Minimum Rate

Before you go freelance, ideally, you must know what you need to charge to pay your bills. This is your minimum rate. I use a simple formula for this; I add up all my costs (rent, utilities, food, tax, office costs, computer software, etc.) for a year. Then I divide by 52 to get a weekly rate. Then I divide by 25 to get an hourly rate

Author/Copyright holder: SMcGarnigle. Copyright terms and licence: CC BY-SA 2.0

Yes, that’s right 25 hours of work a week. Why? Because when you freelance a lot of your time is unpaid. You have to market, invoice, do your admin, etc. and your clients won’t pay for that.

Finally, I add 10% to that hourly rate for unforeseen circumstances (and because we all miss something during that add up of costs).

If you work for less than this amount; you are effectively paying a client to work for them because you won’t be able to cover your costs and will be going into debt to do so. Your minimum rate is not your target rate – but if you have to take low budget projects to fill spaces in your diary they should never be below your minimum rate either.

Know the Market Rate

Do some research. Find out what people pay for the kind of work you do as a freelancer. Check out your industry bodies and find out what they see as market rate. The market rate is essentially your maximum rate – while some highly experienced freelancers may be able to break the ceiling on market rates; new freelancers typically can’t.

Fixed Price Contracts vs Hourly Rates

Many freelance jobs don’t pay an hourly rate. The client pays for a fixed volume of work and a fixed price for that work. This can be good if you’re a fast worker and bad if you’re a little slower than average.

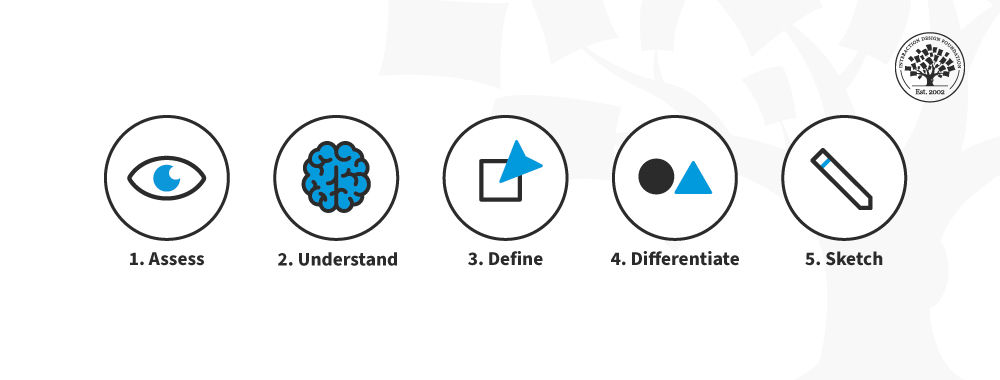

Author/Copyright holder: Pedro Cambra. Copyright terms and licence: CC BY 2.0

Your hourly rate needs to be competitive – ideally somewhere between your minimum rate and the full market rate when you start out in business with the objective to raise yourself up to the full market rate within 18 months of starting out.

Pricing a fixed rate contract is simple. Estimate the average time it would take an average person to do the job. Then add 10% (a safety net). Then multiply this length of time by your hourly rate. That’s the proposed cost of your fixed price job. Don’t hesitate to round up a little to make the figure seem normal – no one is going to expect to see a price of $5123.27 as your final price. Quote $5,200 instead.

That’s it – how to calculate the going rate for your services is actually pretty straightforward. Just keep an eye on your minimum and the market rate over time; they’re both going to go up at some point.

Header Image: Author/Copyright holder: Shaprstick's photos. Copyright terms and licence: CC BY-NC 2.0