Four common options exist in most parts of the world. The options include sole trading, partnerships, limited companies, offshore companies. Learn the advantages and disadvantages of each—it’s vital on the path to running an efficient business.

We’ll teach you the most common options and the usual advantages and disadvantages of each option; these may vary from place to place, from country to country.

Because the legal environment for businesses varies by location, always talk to a business advisor or legal advisor before settling on your choice of setup.

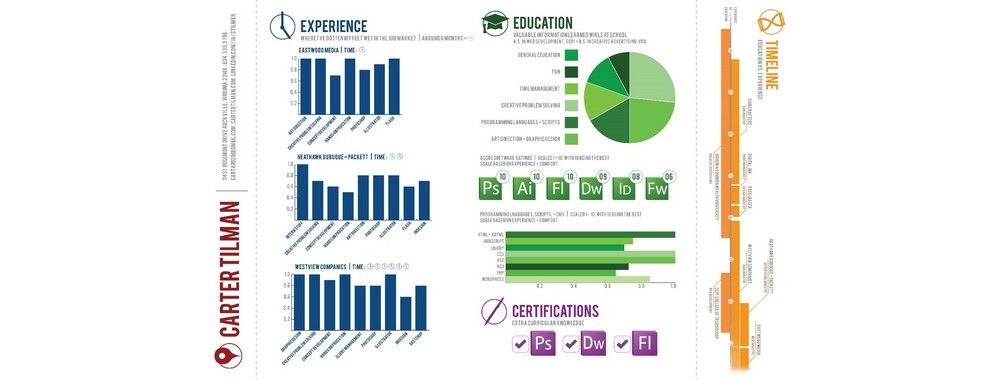

Option 1: The Sole Trader

No figures exist on how freelancers and entrepreneurs choose to operate their businesses, but we would bet that about 90% of freelancers start their freelance careers as sole traders. It’s also a very popular choice for new small companies.

A sole trader is simply a business that consists of a single person. In most jurisdictions, you do not have to register a sole trading entity (though you may be able to) with any government authority. However, in some places—Cambodia, for example—you would have a legal requirement to register a sole-trading business – this is normally much cheaper and easier to do than creating any other type of entity. Likewise in Denmark, you have to register your new sole-trading entity, but it can be done online in less than 15 minutes with no costs.

The advantage to being a sole-trading entity is simple; it’s cheap and easy to become a sole trader. In much of the world, you can just say “I’m a sole trader” and that’s all the effort you have to put in.

Author/Copyright holder: Chris Beckett. Copyright terms and licence: CC BY-NC-ND 2.0

Author/Copyright holder: Chris Beckett. Copyright terms and licence: CC BY-NC-ND 2.0

When we talk about “sole traders” we don’t mean people who sell shoes or soles – we mean a person who runs a business which is only made up of himself or herself and which takes little effort to form in most places.

Let’s take a look at the advantages and disadvantages of this kind of business:

Advantages

No/low setup cost

Can start trading immediately

No licences are usually required to run a sole-trading entity (though this may not be true everywhere).

Taxation tends to follow income tax. Subtract your expenses from your takings and file a return on the difference, although, in some places, such as Cambodia, you may find that a sole trader has a fixed annual rate of tax, and no income tax is required.

In some countries there are also no need to register for VAT (Value-added Tax), but you should check this thoroughly online or talk to a business or legal advisor.

Disadvantages

A sole trader has no limit to his or her liability. If your business goes bankrupt, you are personally liable for its debts. That means your home, your personal goods, and your bank account may be used to settle the debts.

You cannot always claim VAT back as a sole trader—the flipside to not having to charge VAT.

You may find it difficult to get a business bank account and have to use your personal banking facilities instead.

You may find it difficult to access grants, business support services, etc. as a sole trader – many of these schemes are only open to limited (liability) companies.

Sole traders are also often excluded from tax incentive programs aimed at businesses.

Option 2 – Partnership Agreements

This option won’t apply to most freelancers. It’s only used when a group of freelancers come together and decide to work with each other.

However, a partnership is not a commonly used structure for groups of freelancers, either. By and large, it has the same advantages of a sole trader (though incorporation may take longer and cost more) and the same disadvantages.

But—a partnership has one major additional disadvantage. Each partner is jointly and severally liable for the company’s debts. That means if a partnership goes bankrupt, you could find yourself, if your partners have no money/assets, paying for all the debt (even if you didn’t incur that debt) yourself.

That disadvantage is so big that partnerships are very uncommon, except in certain fields such as law and accountancy.

Given that, it’s unlikely that any freelance group will choose a partnership arrangement.

Author/Copyright holder: Wellcome Images. Copyright terms and licence: CC BY 4.0

Author/Copyright holder: Wellcome Images. Copyright terms and licence: CC BY 4.0

The partnership agreement has been around for a very long time, but it has a lot of disadvantages, and most freelancers and entrepreneurs will steer clear of this type of company setup.

Option 3 – Limited (Liability) Companies

Depending on where you are in the world, limited companies are denoted by “Ltd.” or “LLC” after their names.

A limited company must be incorporated. Fees for this range from negligible to large sums, depending on where you are basing the company.

You can start a limited company by yourself, or as a group. You can issue shares in that company, although you may not trade those shares on a stock exchange.

Let’s take a look at the advantages and disadvantages of a limited liability company:

Advantages

As long as a limited company is managed properly (something that will be defined by the law of your country), if it goes bankrupt, then any debts are the liability of the company and not the owners. That means if the company’s assets are sold and there is a shortfall with debt remaining, you do not have to pay that debt. This is the biggest reason that people open limited companies.

You may, depending on where your company is based, be able to claim back VAT on anything that your company buys in order to conduct its business. In several countries, you can, for example, claim back VAT on your business computer, internet, and business-related travels, business-related restaurant bills, etc.

You can sell shares in the company to investors or partners.

You may be able to apply for grants, loans, etc. more easily than a sole trader or a partnership.

You will find it relatively easy to get a business bank account—as long as you meet the bank’s criteria for deposits, etc.

You may find that larger customers prefer to deal with a limited company than a sole trader or a partnership

Disadvantages

It will normally cost more to set up a limited company than a sole tradership.

It may take a long time to set up a limited company (though it may not – you can set up a limited company in the UK, for example, in less than a day).

You will normally have to file annual accounts for a limited company, which can be expensive.

You may, in some places, have to make your accounts available publicly.

You will have to follow a more complex tax regime as a limited company than as a sole trader in most places.

There are often legal obligations on shareholders and directors of limited companies that may be (or may not) be difficult to comply with.

You may need to establish an office, whereas most sole traders can work from home.

You may have to hire a company secretary for incorporation purposes.

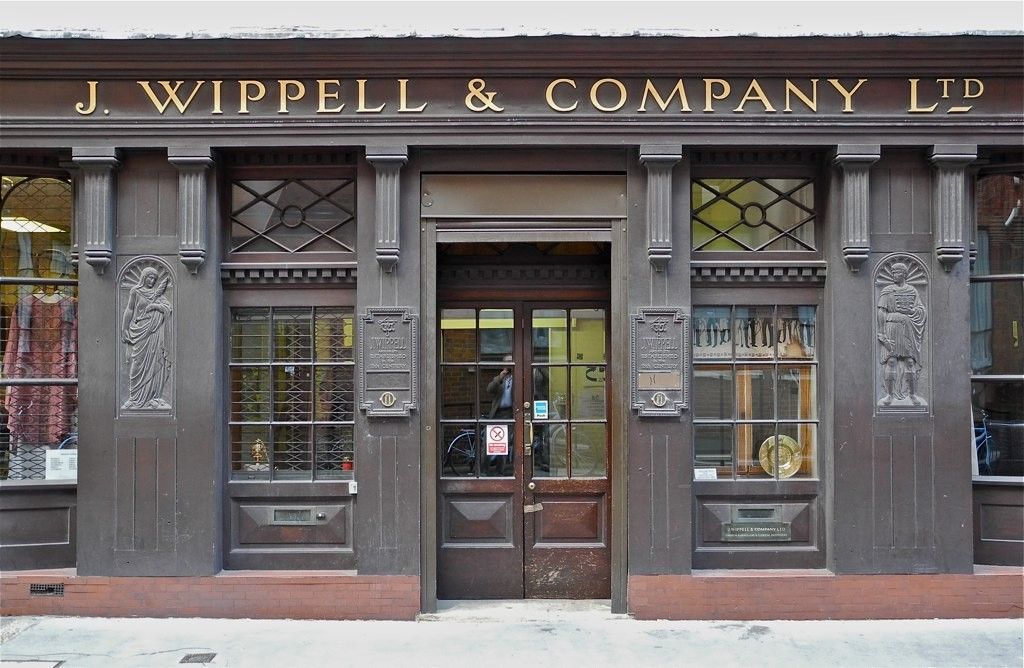

Author/Copyright holder: jansos. Copyright terms and licence: CC BY-NC 2.0

Author/Copyright holder: jansos. Copyright terms and licence: CC BY-NC 2.0

Limited companies will have either “Ltd.” or “LLC” or something similar in their name. They offer freelancers and entrepreneurs more protection when running a business, but they cost more to operate, too.

Option 4 – Public Limited Companies (PLC)

Theoretically, you could start a public limited company and offer shares to investors via the stock exchange. In reality, only medium- to large-sized companies do this. It costs a lot of money (think $100,000+) to go through an initial public offering (IPO), and there are no good reasons for a freelancer to choose this route of incorporation.

You may want to examine this if your freelance business grows into a larger business and you have substantial amounts of intellectual property and need to raise finances for expansion. When you’re just starting out, the PLC structure holds no value at all.

Offshore Entities

An offshore entity is a company held in a location in which you do not reside and in which you do not work. In general terms—they are held for tax efficiency. Not all freelancers and entrepreneurs can benefit from such tax efficiency, and it’s a good idea to talk to a tax advisor before you choose an offshore entity. Common locations for offshoring include Panama, Hong Kong, the British Virgin Islands, the Canary Islands, etc.

Freelancers and entrepreneurs who are digital nomads may want to explore their options to create an offshore limited company, LLC or Ltd. This can be very tax efficient as well as minimize liabilities. However, this is a complex area of law, and you should seek legal advice before pursuing an offshore entity. If you do not intend to live outside of your usual tax environment, an offshore entity will almost certainly be seen as an attempt at tax evasion—you might open yourself up to prosecution resulting in fines and/or jail time.

Author/Copyright holder: Diliff. Copyright terms and licence: CC BY 3.0

Author/Copyright holder: Diliff. Copyright terms and licence: CC BY 3.0

Hong Kong is a very popular place for digital nomads to register an offshore entity – you need to be careful when using offshore entities for business purposes and should take legal advice before committing to a destination.

Overseas Entities

An overseas entity is a company you register in the country that you intend to work in – these will need to comply with local tax laws, employment laws, etc. They are very different structures from offshore entities. Every country on earth has additional rules for overseas investors. In some places, such as Kyrgyzstan and Cambodia, these are not particularly burdensome. In others, such as China and Thailand, they are very burdensome indeed. If you want to set up your freelance business in another country and you want to register an entity—take legal advice.

The Take Away

For the vast majority of newbie freelancers and entrepreneurs, the choice of company vehicle will boil down to a sole trader or a limited company. Most will opt for the sole trader to start with as it is low cost and they do not intend to run up any substantial debts in the business name. Some will choose a limited company for the benefits that it offers and pay the increased costs willingly.

For the best advice on choosing a company vehicle, always talk to a lawyer or qualified business advisor. The material in this article is to help you understand your options, not to make a recommendation on the right choice for your business.

Finally, remember what Walt Disney said—“The way to get started is to quit talking and begin doing.” Don’t spend too much time choosing a company structure; it will stop you from doing – you can always change the structure in the future if you need to.

References & Where to Learn More

Hero Image: Author/Copyright holder: Someformofhuman. Copyright terms and licence: CC BY-SA 3.0

Entrepreneur magazine offers some additional advice on choosing a company structure.