A simple rule of thumb is that you should start looking for venture capital after you’ve run out of all other possible sources of funding. Venture capital is very tempting but it has the drawback of taking a big chunk of your business away from you. The longer you leave it before you reach for venture capital – the more of your business you’ll be left with after the investors arrive.

Not On Day One

Venture capitalists don’t pay for ideas. It doesn’t matter how good your idea is – it has no value at all until you can demonstrate that it works. There’s no security in giving money to someone with an idea; without patents, copyrights, trademarks, etc. you have no intellectual property to stand as security. You also don’t have a product, any customers, etc. that might make investing in you worthwhile.

Author/Copyright holder: c_ambler. Copyright terms and licence: CC BY 2.0

So don’t bank on starting a business with $10 million from a friendly venture capitalist – it’s not going to happen.

Times When You May Be Able to Get Cash

There are times in the company lifecycle where you’ll need to seek cash. One of the major reasons for startup failure is a lack of cash.

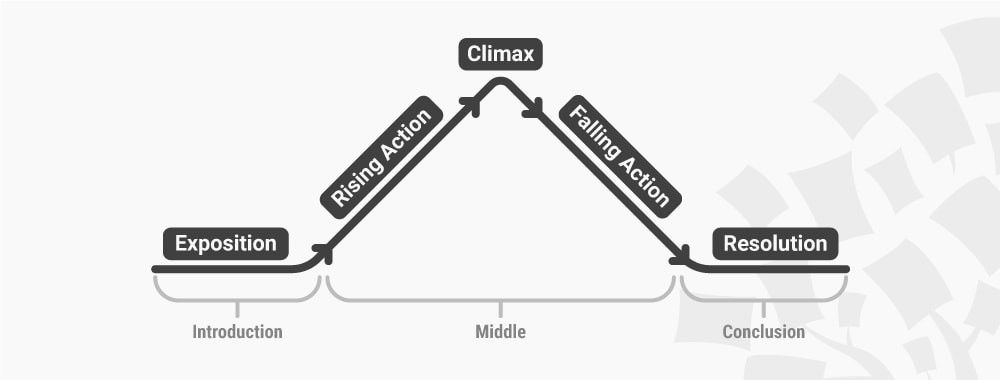

Author/Copyright holder: zizzybaloobah. Copyright terms and licence: CC BY-NC 2.0

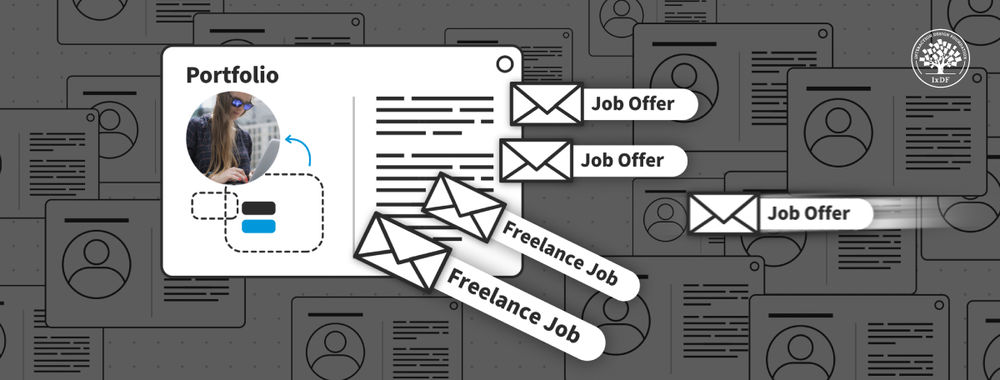

Once again, you should try all other sources before looking for venture capital. The later you leave it, the more likely you will be to get VC funding (a business that has launched and has customers is way more appealing than one in a prototype testing phase) and the less of your business you will have to give away:

- The beta-testing phase. This isn’t a great time to look for cash but you should at least have a prototype and any IP available by now.

- Following the first shipment of products. If you’re selling products to customers and getting good feedback – this is a great time to seek VC funding.

- Business ramp up stage. If you’re selling a product and need cash to expand; VC investors are very likely to be interested. This is especially true if you have a proven business model (and can show efficiency savings in acquisition costs and increased profitability).

Bad Times to Seek Funding

Author/Copyright holder: Unknown. Copyright terms and licence: Unknown. Img source

If you run out of money mid-cycle before reaching a milestone for VC funding; it’s going to look like bad management and that’s going to put VC investors off. You need to keep a close eye on what you’re spending through a milestone and make it last until you hit the appropriate phase.

Don’t Be Too Cautious

Author/Copyright holder: David Tan. Copyright terms and licence: CC BY-NC-ND 2.0

It’s less commonly known that some enterprises fail because they took too long to get more money in. They don’t struggle because they’re not making money; they fail because they don’t get large enough, fast enough to see off competitors and to firmly establish themselves. If you’re a CEO wondering whether to seek VC funding it’s always best to talk to an accounting professional and then hit the go button if they think that you should.

Header Image: Author/Copyright holder: Kevin Dooley. Copyright terms and licence: CC BY 2.0