The Endowment Effect is a contradiction of the classical economic idea that people always behave rationally within an economic system. It is the surprising idea that we are prepared to pay more money to retain something that we already own than we would pay for the item if we did not own it. It is often also shown that we are unwilling to trade something that we already own in exchange for something of equal value (regardless of whether that item is more or less desirable than the item we already own).

Experimental Evidence of the Endowment Effect

Daniel Kahneman, the Nobel Prize winning economist, Jack Knetsch and Richard Thaler, who are also highly respected economists, in their 1990 paper; “Experimental Tests of the Endowment Effect and the Coarse Theorem” showed the Endowment Effect in action.

They conducted a series of experiments in which participants were offered the chance to buy a mug. They were asked to assign a value that they would be willing to pay for the mug. Then they were given (they did not have to pay for it) the mug.

They were then asked if they wanted to trade their mug for objects of equal value, pens. They were invited to decide how many pens they wanted in exchange for their mug. They determined that on average participants wanted twice as many pens for their mug. That is, they valued the mug twice as much when it was already theirs than they valued it when it wasn’t theirs.

![]() Author/Copyright holder: Pixabay. Copyright terms and licence: Free to Use.

Author/Copyright holder: Pixabay. Copyright terms and licence: Free to Use.

Why Does the Endowment Effect Exist?

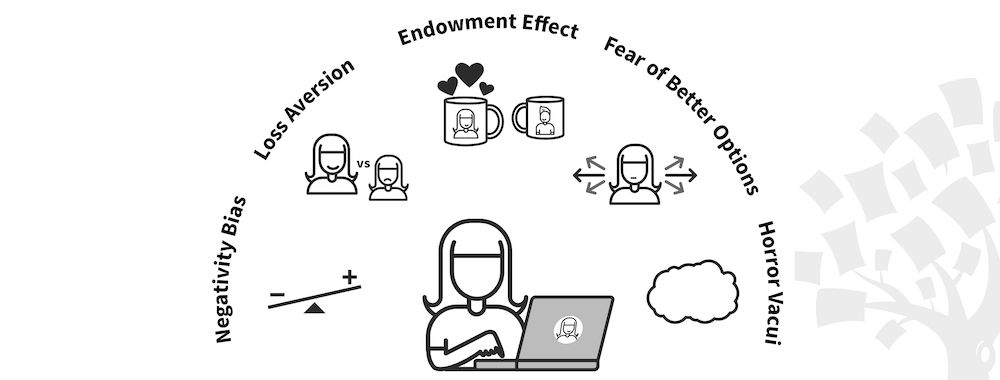

There are many explanations for the endowment effect. Daniel Kahneman’s own research offers 3 possible explanations: that it involves loss aversion (the idea that we feel the pain of loss twice as strongly as we feel pleasure at an equal gain), reference-dependence (the idea that we weigh a loss before a gain and thus weigh it more heavily than the gain), and a neoclassical effect (the idea that we are indifferent to the change and thus expect to be compensated more highly for the effort involved).

There are other theories that involve psychological concepts and others still that believe this is an evolutionary effect.

Whichever, explanation we accept – it is fairly certain that the endowment effect exists. However, it is worth noting that there are criticisms of the idea too. And that in particular, Michael Hanemann (pictured below) in 1991, demonstrated that the endowment effect only appears to be present when exchanges of similar goods of equal value are being considered.

![]()

Author/Copyright holder: Xlouteiro. Copyright terms and licence: CC BY-SA 4.0

Why Does the Endowment Effect Matter to Designers?

If you know that someone feels the loss of something they own more severely than they anticipate the gain of something of equal value and you know that this is likely to make them pay more to retain what they own – you can increase product adoption and user retention.

For example, if you have a digital product such as an app or a magazine subscription. You can offer a free-trial for that product. This reduces the initial cost, and thus initial risk, of the decision making process to zero. Someone is more likely to become a user of your product when there is no risk to doing so. And don’t forget people like free stuff too – Sandra Bullock, the Oscar winning actress says; “I’ll do anything for free stuff.”

However, it also makes it less likely that when the free-trial is over that the user will give up the product. The endowment effect means that they are going to feel some pain about surrendering the product.

Interestingly, the endowment effect also suggests that because we value a product about twice as much when it is ours than when it is not – someone may be willing to pay more for a product following a free-trial than they would if they had to pay for the product without such a trial.

![]() Author/Copyright holder: Pramod Patil. Copyright terms and licence: Fair Use.

Author/Copyright holder: Pramod Patil. Copyright terms and licence: Fair Use.

The endowment effect is also invoked by offering a money back guarantee. While this requires that the user adopts the product and takes some risk when they do so – it offers security that they can, for a period of time, reverse that decision.

Yet again, the endowment effect suggests that once the person owns the product they would pay twice as much to keep it than they would have paid for it originally. Thus they are unlikely to take advantage of the money back offer because the money back is only worth what they have originally paid for it.

There are many other ways, in theory, to manipulate the endowment effect but these are the two most commonly used to encourage product adoption and then retention of that product.

It is worth noting that the endowment effect, in these instances, is only likely to apply if the product is perceived to have value to the user in the first place. If your product is a buggy, frustrating mess – users are still going to return it.

The Take Away

The endowment effect is the idea that we value something we already own more highly than something of equivalent that we do not. This effect can be exploited by designers looking to increase adoption and retention of use with products for example by offering a free-trial or a money back guarantee.

References

Daniel Kahneman, Jack L. Knetsch and Richard H. Thaler (1990). "Experimental Tests of the Endowment Effect and the Coase Theorem". Journal of Political Economy 98 (6): 1325–1348.

Hanemann, W. Michael (1991). "Willingness To Pay and Willingness To Accept: How Much Can They Differ? Reply". American Economic Review 81 (3): 635–647.

Kahneman, Daniel; Tversky, Amos (1979). "Prospect Theory: An Analysis of Decision under Risk".Econometrica 47 (2): 263.