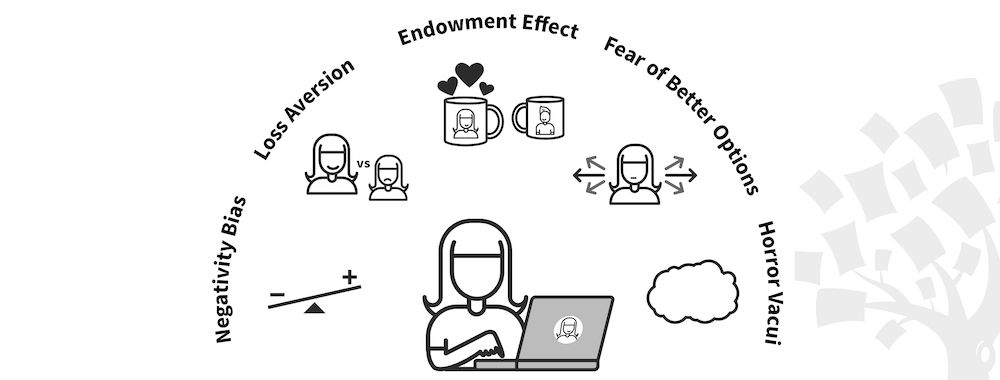

There’s a cognitive bias that makes us sadder to lose something than it makes us happy to gain it. This causes us to be afraid of loss – even when that fear is illogical. It prevents us from taking small risks to make big gains, for example. Overcoming loss aversion can help you build better products and manage your life in a more objective manner.

Loss aversion is a cognitive bias which is most readily identified by economists rather than psychologists. It’s the fear of losing something particularly when the rewards for that loss are unclear. The bias occurs when it’s hard to weigh up the consequences of loss.

![]()

Author/Copyright holder: Pixabay. Copyright terms and licence: Free to Use.

Yet, in order to benefit from something we often have to give something else up in return. You do it every time you go shopping – you get food and you give up money. Without food, you’d starve. But the benefits in this case are clear. When they become hazy; you’re going to be much less likely to part with your cash.

Loss Aversion

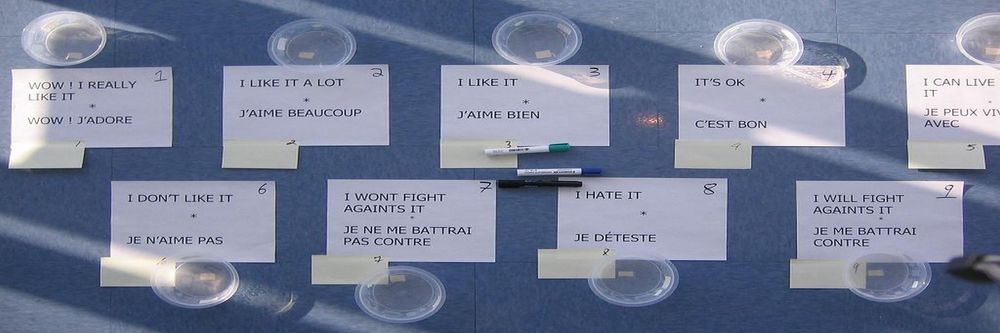

The idea of loss aversion was first proposed in a paper entitled “Choices, Values and Frames” presented by the economists Kahneman and Tversky in 1984. They carried out a series of experiments that showed that people tend to fear a loss twice as much as they are likely to welcome an equivalent gain.

![]()

Author/Copyright holder: JohnKiat. Copyright terms and licence: CC BY-SA 3.

What does that mean? Well in its simplest form – you’re going to be twice as upset to lose $100 as you would be to find $100.

This isn’t a very rational thing to happen. $100 is $100. We should, theoretically, be as happy to gain $100 as we would be sad when we lose $100 but that’s not how we work.

In fact, loss aversion can even come into play depending on the way we phrase something to someone. In that it can be invoked by referring to a loss rather than a gain.

Imagine a cancer patient with 6 months to live. Their doctor comes to them and says; “There’s a new treatment! We’d need to do this right away, if it’s successful you’ll be cured, but there’s a 10% chance that you’ll die during the treatment.”

Then, on the other side of the country, another cancer patient with the same time to live has their doctor visit them; “There’s a new treatment! We’d need to do this right away, if it’s successful you’ll be cured, and there’s a 90% chance that you will survive the treatment!”

The second cancer patient is much, much more likely to take up the treatment than the first. Yet, the two statements are identical. The chances of dying remain at 10% and the chances of living remain at 90% but one statement invokes our fear of loss while the other does not and the stakes don’t come any higher than our lives do they?

This is very important because it means that we need to think about the way we communicate with other people; when we seek action are we focusing too much on what could be lost rather than what could be gained?

We can also influence loss aversion in other people. In fact, designers tap into this often. “Only 1 hour left to order for next day delivery.” (the implication is that you will lose next day delivery if you delay in ordering). “Only 2 of this item left in stock!” (the implication is that you might not be able to order at all if you don’t order now). And so on.

How to Tackle Loss Aversion

The best way to tackle loss aversion is to ask the simple question; “What’s the worst that could happen if I/we took this course of action?”

In the majority of cases, we can quickly put the loss in perspective. “We might not win the contract!” – are you expected to win 100% of contracts that you go for? If you are, you might want to talk to your boss about reasonable expectations and if you’re not, then it might be that losing the contract isn’t really that big a deal.

![]()

Author/Copyright holder: Unknown. Copyright terms and licence: Unknown.

Even with our cancer patients the worst that can happen is that they die 6 months early. The best that can happen is their cancer is cured. It seems likely that their final 6 months with cancer are going to be unpleasant and painful. Dying on the operating table isn’t something to look forward to but it would be painless in comparison to the alternative.

One of the issues with tackling loss aversion is that there’s a good rational basis for loss aversion. None of us want to lose $100, none of us want to lose the contract for our employer, and none of us wants to die. Being risk averse is normal and natural. However, there are times when our aversion to risk prevents us from taking sensible risks that could bring in big rewards.

If you struggle to take risks because of loss aversion and find you can’t overcome this on your own – you could consider working with a coach to overcome this and other cognitive biases.

The Take Away

The fear of losing something is a rational fear. However, we need to put that fear into perspective with our potential gains. Overcoming loss aversion leads to better opportunities not just in design but also in life in general.

You can tap into someone’s loss aversion bias through your designs too. It can be used to drive decision making and sales.

References

Want to read the original economics paper that gave rise to the theory of loss aversion? We’ve got you! Read it here: "Advances in prospect theory: Cumulative representation of uncertainty". Journal of Risk and Uncertainty 5 (4): 297–323.

Dig deep into some other examples of how behavioural economics can affect us.

An interesting take on loss aversion from Being Human, for those interested!

Hero Image: Author/Copyright holder: Pixabay. Copyright terms and licence: Free to Use.